How a Small Group of Traders Improved Markets for All – Bill Harts

Bill Harts, CEO, Modern Markets Initiative

The most liquid stocks in the world used to trade at a minimum spread of one-eighth, but was quite often trading at a quarter spread. If you were an average retail investor buying 100 shares, you would have been paying an extra $25 for that stock, just in terms of the spread costs (putting commission aside). Today, that quarter spread is less than a penny.

The 2014 release of Michael Lewis’ book “Flash Boys” unleashed widespread criticism of the automated trading community amid Lewis’ assertion that markets are “rigged” against small investors. According to Bill Harts, CEO of the Modern Markets Initiative, nothing could be further from the truth.

He says retail investors have never had it so good. Just Amazon drove down the cost of books, so too did electronic trading drive down the costs associated with investments.

He says, yeah, the automated trading community is mad about the Flash Boys controversy, but that the general public should be mad, too. Those who fled the market in the aftermath of the book’s release left tremendous opportunity on the table.

Similar Talks

Staying Ahead of the Technology Curve – Ed Tilly

Ed Tilly - Cboe Global Markets Let’s say your expertise is in accounting, marketing , legal, the breath of the organization here and the division, we need everything. We continue to hire, we continue to look for talent. That is not going to change at all. In this...

The Birth of Fintech – Anna Irrera

[Fintech] is an incredibly broad term. It means the ATM you’re using in a bodega, but it also means the sophisticated software used to spot fishy behavior in markets. In this video from MarketsWiki Education’s World of Opportunity event in New York, Anna Irrera, a...

Problems, Solutions and Results – Elaine Wah

Elaine Wah - IEX Ultimately I think that anyone who believes in fairness, or believes that people should compete on the merits of their ideas and hard work rather than advantages that they have purchased, can appreciate why IEX was created and why it has succeeded so...

It’s All About the Reach – Julie Armstrong Menacho

Julie Menacho Armstrong - CME Group You don’t have to [meet] every credential and be an ‘A’ on all of it to get to that next role. You just have to believe you can do it, and you need to make others believe you can do it. In this video from MarketsWiki Education’s...

How Algo “Lego” Technologies Make Markets Safer – Rick Lane

Rick Lane - Trading Technologies We already have computers, why don't we start automating it. Technology has taken over the financial markets during the past 25 years. Today, trades are done in microseconds via computer algorithms and powerful servers. Rick Lane, CEO...

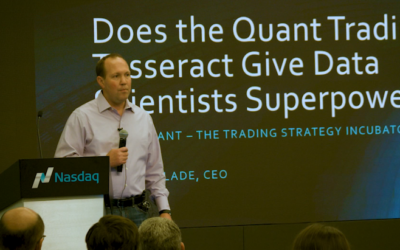

Quant Trading and Superpowers – Morgan Slade

Morgan Slade - CloudQuant You have a chance, single-handedly, without anyone looking at your resume, to try and change an industry. In this video from MarketsWiki Education’s World of Opportunity event in New York, Morgan Slade, CEO of CloudQuant, discusses the...

Connect With Us

If you like what you see here and are interested in becoming involved, or have questions about our programs, videos or web sites, please put your name, email address and a brief message into this form and we will get back to you as soon as possible.